Planning

5 Best Yearly Budget Planners We Have

I’m here to share with you the top 5 Yearly Budget Planners that will help you master your finances. These planners are perfect tools for organized spending and savvy saving this year. Let’s dive in and explore the features and benefits of these incredible tools.

Key Takeaways:

- These Yearly Budget Planners are essential for taking control of your finances.

- They are designed to assist you in achieving your financial goals and staying organized.

- By tracking your expenses with these planners, you can effectively manage your money.

- Investing in a Yearly Budget Planner is a great step towards financial discipline.

- Choose the perfect planner that aligns with your preferences and start your journey towards a brighter financial future.

A Closer Look at Yearly Budget Planners

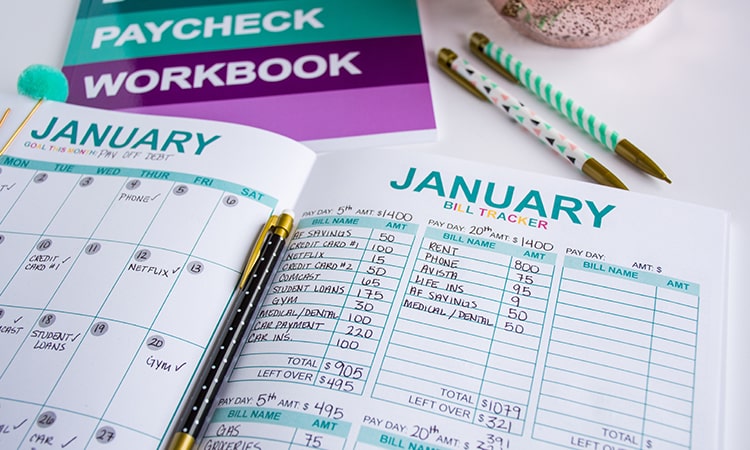

Now that we’ve established the importance of Yearly Budget Planners in controlling your finances, it’s time to delve into the intricate details of these indispensable tools. Yearly Budget Planners are not just limited to helping you keep track of your expenses; they provide a comprehensive approach to organized spending and savvy saving.

One of the key features that sets Yearly Budget Planners apart from other financial tools is their ability to provide a bird’s-eye view of your financial landscape. With a clear and structured layout, you can easily visualize your income, expenses, and savings goals at a glance. This enables you to make informed decisions and ensures that you stay on track throughout the year.

The Power of Tracking Expenses

Before we dive further into the benefits of Yearly Budget Planners, let’s emphasize the importance of tracking expenses. It’s no secret that financial success starts with understanding where your money goes. By diligently recording every transaction, you bring much-needed visibility to your spending habits and uncover areas where you can make adjustments to maximize your savings.

- Identify unnecessary expenses and eliminate them.

- Set realistic budgets for different categories of spending.

- Monitor your progress and identify areas for improvement.

A Yearly Budget Planner acts as a reliable companion throughout this journey, helping you analyze your spending patterns and make well-informed financial decisions.

“A Yearly Budget Planner is like having a personal financial assistant guiding you towards your goals.” – Financial Expert

Visualize Your Financial Goals

Beyond tracking expenses, Yearly Budget Planners are a powerful tool for goal setting and visualization. Whether you’re planning a dream vacation, saving for a down payment on a house, or looking to build an emergency fund, these planners enable you to break down your financial aspirations into achievable milestones.

With the ability to set realistic targets and timelines, you’ll find yourself motivated and accountable. Each step towards your financial goals will be clearly outlined, making it easier to celebrate your progress and stay motivated throughout the year.

Comparison of Yearly Budget Planners

| Feature | Yearly Budget Planner A | Yearly Budget Planner B | Yearly Budget Planner C |

|---|---|---|---|

| Layout | Clean and minimalist | Vibrant and colorful | Classic and elegant |

| Customization | Highly customizable | Limited customization options | Moderate customization options |

| Expense Tracking | Comprehensive tracking features | Basic tracking capabilities | Detailed expense categorization |

| Savings Goals | Integrated savings goal tracker | Separate savings tracker | Savings progress visualization |

Table: Comparison of Yearly Budget Planners

As you can see from the above comparison, each Yearly Budget Planner offers unique features and customization options. Consider your personal preferences and specific budgeting needs when choosing the perfect planner that aligns with your financial goals.

Now that we’ve explored the features and benefits of Yearly Budget Planners, it’s time to uncover the numerous advantages of incorporating these tools into your financial routine. In the next section, we’ll discuss the benefits of using Yearly Budget Planners and how they can revolutionize your financial management.

The Benefits of Using Yearly Budget Planners

When it comes to managing your finances effectively, incorporating a Yearly Budget Planner into your financial routine can be a game-changer. These planners offer numerous benefits that can help you stay financially disciplined and achieve your financial goals.

Promotes Accountability

One of the key benefits of using Yearly Budget Planners is the promotion of accountability. By writing down your income and expenses, you gain a clear understanding of where your money is going. This accountability empowers you to make smarter financial decisions and avoid unnecessary spending.

Provides Holistic Expense Tracking

A Yearly Budget Planner allows you to track your expenses comprehensively. By recording all your expenditures in one central place, you can easily monitor and analyze where your money is being spent. This enables you to identify areas of overspending and make adjustments to ensure your financial goals are on track.

Helps Achieve Financial Goals

Yearly Budget Planners are powerful tools for setting and achieving financial goals. With a clear overview of your income and expenses, you can create realistic savings targets and track your progress towards them. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, these planners provide the necessary structure to help you reach your financial milestones.

Improves Money Management

By using a Yearly Budget Planner, you develop effective money management habits. These planners encourage you to make informed decisions about your spending, prioritize your expenses, and allocate funds appropriately. As a result, you gain a greater sense of control over your finances and can make your money work harder for you.

Using a Yearly Budget Planner is like having a personal financial assistant. It keeps you organized, focused, and accountable, ensuring that you are on the right track to achieving your financial goals.

In conclusion, incorporating a Yearly Budget Planner into your financial routine offers a range of benefits, from promoting accountability to providing a holistic view of your expenses. With these planners, you can stay on top of your finances, track your expenses effectively, and work towards your financial goals with confidence.

Comparison of the Top 5 Yearly Budget Planners

When it comes to managing your finances effectively, having the right tool can make all the difference. In this section, we will compare the features, layouts, and customization options of the top 5 Yearly Budget Planners. By examining their unique offerings, you’ll be able to choose the one that best suits your needs.

1. Budget Planner Pro

Budget Planner Pro is a comprehensive budgeting tool that offers a user-friendly interface and customizable categories. With its intuitive design, you can easily track income, expenses, and savings goals. The planner provides detailed reports and graphs to help you visualize your financial progress.

2. Live Rich Planner

The Live Rich Planner is more than just a planner. A tool to help you organize and anticipate every aspect of your life, it’s designed to encourage you to plan, attack your goals, dream big, and be creative. Most importantly, this planner was created to make your life easier.It offers a wide range of features, including expense tracking, bill reminders, and debt management. The planner also provides actionable insights and recommendations to help you optimize your spending.

3.Clever Girl Finance Budget Planner

Clever Girl Finance® is one of the largest personal finance media/education platforms for women in the U.S. Founded by Bola Sokunbi, the company is driven by its mission to guide and empower women to build financial confidence and make smart money decisions.

Set, track, and achieve your financial goals with this new, coiled Clever Girl Finance Budget Planner. Featuring the best of our popular PetitePlanner Budget Book + tips and stickers from Clever Girl Finance.

This budgeting book is filled with so much functionality and planning potential! The easy-to-use monthly expense logs help you categorize your expenditures and help you see your spending patterns. Keep track of monthly recurring expenses, log your weekly spending habits, and use this budget book to meet your savings goals.

4. Pocket Budget

Pocket Budget is a mobile-friendly budgeting tool that allows you to track your income and expenses on the go. It offers a simple and streamlined interface, making it easy to manage your budget anytime, anywhere. The planner also provides personalized recommendations to help you improve your financial health.

5. Smart Money Manager

Smart Money Manager is a comprehensive budgeting app that offers a wide range of features, including expense tracking, goal setting, and bill management. It provides real-time data and personalized insights to help you stay on top of your finances. The planner also offers budgeting tips and strategies to help you achieve your financial goals.

Choosing the right Yearly Budget Planner is crucial for effective financial management. Consider your specific needs and preferences when comparing these top 5 planners. Whether you prioritize customization, simplicity, or advanced features, there is a planner that can help you take control of your finances and achieve your financial goals.

Conclusion

In conclusion, investing in a Yearly Budget Planner can have a significant impact on your financial management skills. These planners are not just for stationery enthusiasts; they are practical tools that can help you take control of your money and achieve your financial goals. With a Yearly Budget Planner, you can track your expenses, create budgets, and plan for future expenses.

By using a Yearly Budget Planner, you will have a clear view of your financial situation, allowing you to make informed decisions about your spending and saving habits. These planners provide a structured approach to managing your finances, giving you a roadmap to financial success. Whether you want to pay off debt, save for a big purchase, or build an emergency fund, a Yearly Budget Planner can help you stay organized and focused on your goals.

Remember, finding the perfect Yearly Budget Planner that suits your preferences and needs is essential. Take the time to explore different options and consider factors like layout, customization options, and additional features. Choose a planner that resonates with you and jumpstart your journey towards a brighter financial future.

FAQ

What is a Yearly Budget Planner?

A Yearly Budget Planner is a tool designed to help individuals track and manage their financial activities over the course of a year. It provides a structured layout for budgeting, tracking expenses, and setting financial goals.

How can a Yearly Budget Planner benefit me?

Using a Yearly Budget Planner can offer several benefits. It allows you to have a clear overview of your financial situation, helps you stay organized with your spending, enables you to track your expenses, and assists in achieving your financial goals.

Can I customize a Yearly Budget Planner to fit my needs?

Yes, many Yearly Budget Planners offer customization options. You can choose planners with different layouts, sections, and features to best meet your personal preferences and financial management style.

Are Yearly Budget Planners only for people with high income?

No, Yearly Budget Planners are beneficial for individuals at all income levels. They are valuable tools for anyone looking to improve their financial management skills, regardless of their income or financial situation.

Where can I purchase Yearly Budget Planners?

Yearly Budget Planners can be found at various retailers, both online and in physical stores. Stationery stores, bookstores, and online marketplaces like Amazon are great places to start your search.