Planning

How To Use A Monthly Budget Planner

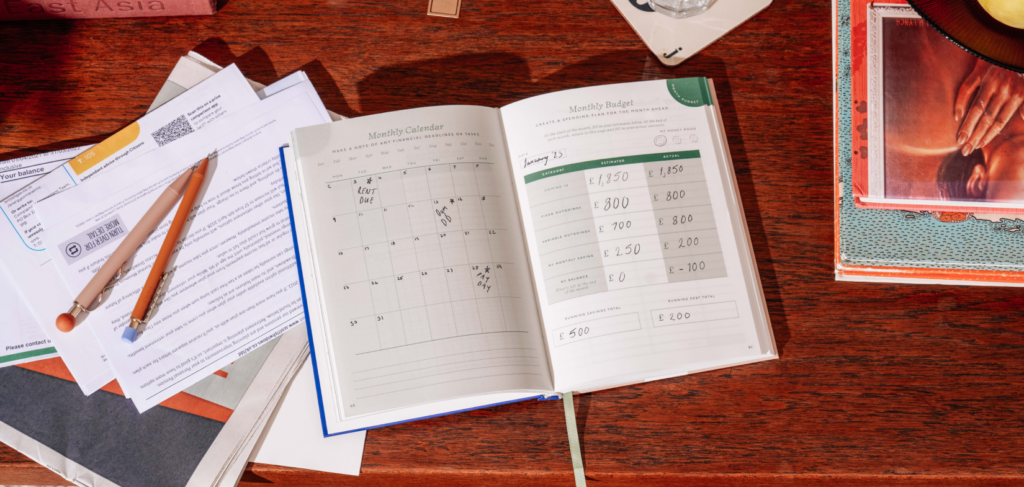

I will guide you through the process of effectively using a monthly budget planner. Budgeting is an essential skill for managing your finances and achieving your financial goals. By using a monthly budget planner, you can gain control over your expenses, track your income, and make informed financial decisions.

Key Takeaways

- Monthly budget planners are valuable tools for managing your finances and achieving financial goals.

- They help you gain control over your expenses and track your income.

- By using a monthly budget planner, you can make informed financial decisions and prioritize your spending.

- Effective budgeting is crucial for achieving financial stability and preventing unnecessary debt.

- Start using a monthly budget planner today to improve your money management skills.

The Benefits of Monthly Budget Planner Usage

Implementing a monthly budget planner in your financial routine can bring about a wide range of advantages. By using this valuable tool, you gain clarity on your spending habits, identify areas where you can save or cut back, and ultimately achieve better financial stability. Monthly budget planners provide a visual representation of your income and expenses, making it easier to track your progress towards your financial goals.

1. Gain a Clear Understanding: A monthly budget planner allows you to see where exactly your money is going. By recording your income and expenses, you can determine which categories are receiving the most significant share of your budget. This understanding empowers you to make informed decisions about your spending habits.

2. Identify Areas for Savings: With a budget planner, you can easily identify areas where you can save or cut back on unnecessary expenses. By analyzing where your money is being spent, you can find opportunities to reduce discretionary spending and allocate more funds towards your financial priorities.

3. Achieve Better Financial Stability: By consistently using a monthly budget planner, you can achieve better financial stability. A budget planner helps you track your spending, avoid overspending, and make wiser financial decisions. This tool assists in ensuring that your income covers all necessary expenses and helps you build an emergency fund for unexpected situations.

4. Make Informed Financial Decisions: Monthly budget planners provide valuable insights into your financial health. With a clear overview of your income and expenses, you can make more informed decisions regarding major purchases, investments, and savings strategies. This aids in aligning your financial decisions with your long-term goals and aspirations.

Take a look at the following table for a visual representation of the benefits of using a monthly budget planner:

| Benefit | Description |

|---|---|

| Gain a Clear Understanding | Visualize where your money is going |

| Identify Areas for Savings | Look for opportunities to save or cut back on expenses |

| Achieve Better Financial Stability | Create a solid foundation for long-term financial security |

| Make Informed Financial Decisions | Align your financial choices with your goals |

In the next section, we will explore effective strategies for money management using a monthly budget planner.

Strategies for Effective Money Management

When it comes to financial planning, incorporating budgeting strategies is key to achieving your goals. With the help of a monthly budget planner, you can gain control over your expenses, track your income, and make informed financial decisions. Here are some effective strategies for managing your money:

- Set Realistic Financial Goals: Start by setting realistic and achievable financial goals. Whether you’re saving for a vacation, paying off debt, or building an emergency fund, clearly define your objectives.

- Track Your Expenses: Take the time to track every expense you make. Whether it’s a small purchase or a monthly bill, recording your expenses will help you identify areas where you can reduce spending.

- Prioritize Your Spending: Evaluate your expenses and identify which ones are essential and which ones can be cut back. Prioritize your spending on necessities, such as housing, utilities, and groceries, before allocating funds to discretionary expenses.

- Make Necessary Adjustments: Regularly review your budget and make necessary adjustments. Life circumstances change, and your budget should reflect those changes. Adjust your spending categories accordingly to stay on track with your financial goals.

By implementing these budgeting strategies, you can maximize your financial resources, prevent unnecessary debt, and work towards achieving your financial goals. Remember that successful money management requires discipline, consistency, and a commitment to long-term financial planning.

“Effective money management is not just about making a budget; it’s about creating a plan for the life you want to live and making conscious financial choices.” – Suze Orman

Why Expense Tracking is Crucial

Expense tracking is a fundamental aspect of effective money management. By keeping a record of your expenses, you can gain insights into your spending habits, identify areas for improvement, and make informed decisions about your finances.

| Benefits of Expense Tracking | How to Track Expenses |

|---|---|

|

|

By tracking your expenses regularly, you can stay on top of your finances, avoid overspending, and make necessary adjustments to achieve your financial goals.

Tips for Using Budgeting Tools

When it comes to managing your finances effectively, utilizing budgeting tools is a game-changer. In this section, I will provide useful tips to help you make the most out of these tools. Whether you prefer budget trackers in the form of apps, spreadsheets, or online platforms, these tips will ensure that you stay on top of your financial game.

1. Choose the Right Budget Tracker

There are numerous budget trackers available, each with its own unique features and functionalities. To select the right one for your needs, consider factors such as user-friendliness, automation capabilities, and integration with your financial accounts. Research various options and read user reviews to find the tracker that aligns best with your budgeting goals.

2. Streamline Your Budgeting Process

Streamlining your budgeting process can help you save time and effort while ensuring accuracy and consistency. Establish a routine for updating your budget tracker regularly, whether it’s on a weekly or monthly basis. Set aside dedicated time to review your expenses, categorize them correctly, and track your progress towards your financial goals. By maintaining a consistent schedule, you’ll make budgeting a seamless part of your financial routine.

3. Leverage Automation Features

Many budget trackers offer automation features that can simplify your budgeting process. Take advantage of these features to automate tasks such as expense categorization, bill payments, and savings contributions. By automating repetitive tasks, you can free up time and ensure that your budget tracker remains up to date.

4. Set Realistic Budgeting Goals

When using a budget tracker, it’s important to set realistic goals that align with your financial situation and objectives. Be honest with yourself about what you can afford and what you need to prioritize. Setting achievable goals will help you stay motivated and track your progress effectively.

5. Track and Analyze Your Spending Habits

A budget tracker is a powerful tool for tracking your spending habits. Regularly review your expenses and identify areas where you can cut back or make adjustments. Look for patterns in your spending behavior and pinpoint any potential problems or areas of improvement. Understanding your spending habits is crucial for making informed financial decisions and optimizing your budget.

By following these tips, you can make the most of your budgeting tools and enhance your financial management skills. With the right budget tracker and a strategic approach, you’ll be well on your way to achieving your financial goals.

Setting and Tracking Financial Goals

In order to achieve our financial aspirations, it is crucial to set clear and measurable goals. By establishing specific milestones, we can effectively track our progress and stay motivated on our journey towards financial success. With the help of a monthly budget planner, we can align our spending habits with our long-term objectives.

Setting Realistic and Measurable Financial Goals

When setting financial goals, it’s important to be realistic and consider both short-term and long-term objectives. By breaking down larger goals into smaller, achievable targets, we can maintain focus and celebrate incremental victories along the way. For example, instead of aiming to save a large sum of money within a year, we can set a monthly savings target that is more attainable.

It’s also essential to make our goals measurable. By attaching specific numbers or timeframes to our objectives, we can objectively track our progress. For instance, rather than stating a vague goal of “saving more money,” we can set a specific target such as “saving $500 each month” or “building an emergency fund of $5,000 within six months.”

Breaking Goals Down into Actionable Steps

Once we have established our financial goals, it’s important to break them down into smaller, actionable steps. This allows us to create a clear roadmap for success. By outlining the necessary actions we need to take, we can proactively work towards achieving our goals.

“Setting clear goals is the first step in turning the invisible into the visible.”

– Tony Robbins

For example, if our goal is to pay off a credit card debt of $5,000, our actionable steps could include creating a repayment plan, reducing unnecessary expenses, and increasing our income through additional sources.

Tracking Progress with a Monthly Budget Planner

A monthly budget planner is an invaluable tool for effectively tracking our financial goals. By consistently updating our income and expenses, we can assess whether we are staying on track or need to make adjustments to our spending habits. Regularly reviewing our budget planner enables us to identify areas where we may be overspending and make the necessary changes to remain aligned with our goals.

Furthermore, a budget planner provides us with visual representations of our progress. This helps to reinforce our motivation and encourages us to keep striving towards our financial aspirations.

Tips for Staying Motivated and Adjusting Goals

Staying motivated throughout our financial journey is key to achieving our goals. Here are a few tips to stay on track:

- Regularly review and celebrate milestones along the way.

- Find an accountability partner or join a financial community for support.

- Visualize the benefits of achieving your goals.

- Revisit and adjust your goals as necessary.

Remember, your financial goals are not set in stone. Life circumstances and priorities may change, and it’s important to adapt accordingly. By using a monthly budget planner, you can easily modify your goals and ensure they continue to align with your current situation.

By setting and tracking financial goals with the help of a monthly budget planner, you can take control of your finances and work towards a brighter financial future.

Overcoming Budgeting Challenges

In this section, I will address common challenges that individuals face when budgeting and provide strategies to overcome them. From unexpected expenses to lifestyle changes, I will offer practical advice on how to adjust your budget and handle financial setbacks. By being prepared for challenges and having a solid budgeting plan in place, you can navigate through any financial situation smoothly.

Unexpected Expenses

One of the biggest challenges in budgeting is dealing with unexpected expenses. Whether it’s a car repair, medical bill, or home maintenance issue, these unexpected costs can put a strain on your finances. To overcome this challenge, it’s important to incorporate a buffer in your monthly budget. Set aside a small amount of money each month for emergencies so that you have a financial cushion when unexpected expenses arise.

Changing Financial Circumstances

Life is full of changes, and your financial situation can change as well. Whether it’s a new job, a pay cut, or a major life event like getting married or having a baby, it’s crucial to adjust your budget accordingly. Take the time to reassess your income and expenses and make any necessary changes to your budget. Prioritize your spending and cut back on non-essential items to align your budget with your new financial circumstances.

Dealing with Debt

Debt can be a significant challenge when it comes to budgeting. High-interest credit card debt or student loans can eat away at your budget and make it difficult to save or achieve your financial goals. To overcome this challenge, create a debt repayment plan and include it in your monthly budget. Allocate a certain amount each month towards paying off your debts and stick to the plan. Consider seeking professional help or exploring debt consolidation options if needed.

| Challenge | Strategy |

|---|---|

| Unexpected Expenses | Incorporate a buffer in your monthly budget for emergencies. |

| Changing Financial Circumstances | Reassess your income and expenses and adjust your budget accordingly. |

| Dealing with Debt | Create a debt repayment plan and allocate a certain amount each month towards paying off your debts. |

Conclusion

Managing your finances and achieving your financial goals can be a challenging task, but utilizing a monthly budget planner can make it much easier. By implementing the strategies, tips, and techniques discussed in this article, you can take control of your expenses, track your income, and make informed financial decisions.

A monthly budget planner serves as a valuable tool for maintaining a clear overview of your financial situation. It allows you to track your spending, identify areas where you can save money, and prioritize your financial goals. By using a budget planner consistently, you can develop healthy financial habits and achieve better financial stability.

Start using a monthly budget planner today and enjoy the benefits of improved money management. With careful financial planning and budgeting, you can save for big purchases, pay off debts, invest in your future, and achieve the financial freedom you desire. Take charge of your financial well-being and set yourself up for long-term success by making the most of your monthly budget planner.

FAQ

How do I use a monthly budget planner?

To use a monthly budget planner effectively, start by listing all your sources of income and fixed expenses. Then, allocate a specific amount for variable expenses such as groceries, entertainment, and transportation. Track your expenses diligently, compare them to your budget, and make adjustments if necessary. Finally, review your budget regularly to ensure you are on track with your financial goals.

What are the benefits of using a monthly budget planner?

Using a monthly budget planner provides several benefits. It allows you to have a clear overview of your income and expenses, helping you identify areas where you can save or cut back. It also enables you to track your progress towards your financial goals, make informed financial decisions, and achieve better financial stability.

What are some strategies for effective money management using a monthly budget planner?

Some strategies for effective money management using a monthly budget planner include setting realistic financial goals, tracking your expenses, prioritizing spending, and making necessary adjustments to stay on track. It is also essential to establish an emergency fund and regularly review your budget to ensure it aligns with your financial priorities.

What are some tips for using budgeting tools effectively?

To use budgeting tools effectively, start by selecting the right tool for your needs, such as an app, spreadsheet, or online platform. Streamline your budgeting process by automating recurring expenses and tracking your expenses consistently. Regularly review your budget and make updates as needed, ensuring accuracy and consistency in your financial records.

How can a monthly budget tracker help with setting and tracking financial goals?

Using a monthly budget planner can help you set and track financial goals by providing a visual representation of your income and expenses. It allows you to allocate specific amounts towards your goals, break them down into actionable steps, and track your progress over time. Regularly reviewing your budget and adjusting your goals as needed will help you stay motivated and on track towards achieving financial success.

How can I overcome budgeting challenges?

Overcoming budgeting challenges requires flexibility and adaptability. Be prepared for unexpected expenses by building an emergency fund. Adjust your budget when faced with lifestyle changes or financial setbacks. Seek guidance from financial experts or use resources such as budgeting apps or online communities to get advice and support. Remember, perseverance and a solid budgeting plan are key to overcoming challenges and achieving financial stability.

How can a monthly budget planner improve my money management skills?

Using a monthly budget planner can improve your money management skills by providing a clear overview of your income and expenses. It helps you understand where your money is going, identify areas for saving or cutting back, and make informed financial decisions. By consistently tracking your expenses and reviewing your budget, you can develop better spending habits and work towards achieving your financial goals.