Planning

Why To Use A Weekly Financial Planner? 10 Reasons

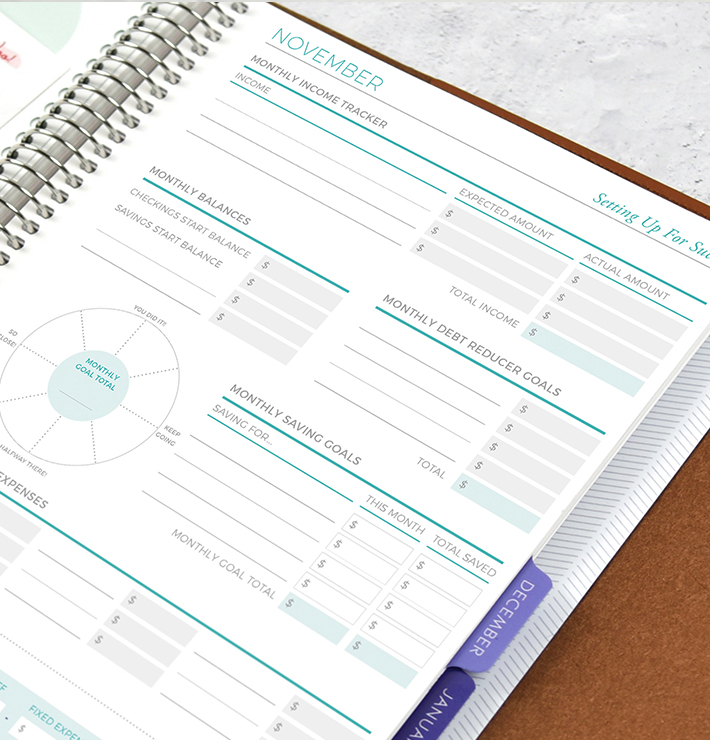

I believe that taking control of our finances is crucial for achieving our financial goals. That’s why I highly recommend using a weekly financial planner. By incorporating this simple tool into your routine, you can gain a clear understanding of your financial situation and work towards financial control and success.

With a weekly financial planner, you can stay on top of your finances and make informed decisions about your money. It allows you to track and manage your expenses, set and track financial goals, and maximize your money management skills. By staying organized and proactive, you can pave the way for a more secure financial future.

Join me as I delve into the 10 reasons why using a weekly financial planner can transform your financial journey, leading you towards financial control and the achievement of your goals.

Key Takeaways:

- A weekly financial planner provides a structure for managing your finances effectively.

- By tracking your expenses, you can gain control over your spending habits and make necessary adjustments.

- Setting and tracking financial goals with a weekly financial planner keeps you focused and motivated.

- Maximizing money management skills through a financial planner helps you make the most of your income.

- Effective expense tracking enables you to identify areas of overspending and improve your financial situation.

Achieve Financial Control

Managing your finances effectively is crucial for achieving financial control and reaching your financial goals. A weekly financial planner can play a vital role in helping you maintain control over your money, track your expenses, and manage your finances efficiently. By implementing a disciplined approach to money management, you can gain a clear understanding of your financial situation and make informed decisions.

One of the key benefits of using a weekly financial planner is the ability to track your expenses. By regularly recording your expenses, you can identify where your money is being spent and make adjustments as needed. This expense tracking feature allows you to analyze your spending patterns and identify areas where you can cut back and save money.

Another essential aspect of financial control is effective money management. With a weekly financial planner, you can set up a budget and allocate your income towards various expenses such as rent, bills, groceries, and savings. This helps you prioritize your spending and ensure that you are living within your means.

By regularly reviewing your budget and making necessary adjustments, you can proactively manage your money and avoid overspending or accumulating debt.

The Benefits of Financial Control:

- Improved financial stability

- Reduced stress and anxiety related to money

- Increased savings and investment opportunities

- Clear understanding of your financial goals and progress

By taking control of your finances and utilizing the features of a weekly financial planner, you can achieve financial control and pave the way for a brighter financial future.

Financial Control Statistics

| Statistic | Financial Control Percentage |

|---|---|

| No Budget | 54% |

| Follows Budget | 46% |

Set and Track Financial Goals

Setting and tracking financial goals is a crucial aspect of managing your personal finances effectively. With the help of a weekly financial planner, you can establish clear objectives and create a roadmap towards financial success. Here are some tips and strategies to help you set and track your financial goals:

1. Define Your Financial Goals

Before you start budgeting and tracking your expenses, it’s important to identify your financial goals. Whether you want to save for a down payment on a house, pay off debt, or build an emergency fund, clearly defining your goals will give you a sense of purpose and motivation.

2. Break Down Your Goals

Once you’ve established your financial goals, break them down into smaller, more manageable targets. This allows you to track your progress and celebrate milestones along the way. For example, if your goal is to save $10,000, you could aim to save $200 per week or $800 per month.

3. Create a Weekly Budget

A weekly budget is an essential tool for managing your finances and working towards your goals. Start by tracking your income and expenses to get a clear picture of where your money is going. Then, allocate funds for essential expenses, savings, and debt repayment. A weekly budget helps you stay disciplined and make adjustments as needed.

- Calculate your weekly income

- List your essential expenses (rent/mortgage, utilities, groceries)

- Allocate funds for savings and debt repayment

- Identify areas where you can cut back on non-essential expenses

4. Track Your Progress

Monitoring your progress is key to staying on track with your financial goals. Use your weekly financial planner to track your income, expenses, and savings. Consider using online tools or mobile apps that can automatically sync with your accounts and provide a comprehensive overview of your finances.

5. Stay Flexible and Adjust When Needed

Life is unpredictable, and circumstances may change along the way. It’s important to stay flexible and adjust your goals and budget as needed. If unexpected expenses arise, reassess your budget and find ways to accommodate them without compromising your long-term financial goals.

By following these budgeting tips and utilizing a weekly financial planner, you can set and track your financial goals effectively. Remember, consistency and discipline are key to achieving financial success.

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

| Benefits of Setting and Tracking Financial Goals |

|---|

| 1. Provides clarity and focus |

| 2. Helps prioritize spending |

| 3. Motivates and encourages progress |

| 4. Identifies areas for improvement |

| 5. Boosts financial confidence |

Maximize Money Management

When it comes to effectively managing your finances, a weekly financial planner can be a game-changer. By incorporating this simple tool into your routine, you can take your money management skills to the next level and optimize your financial efficiency. Here are some key ways in which a weekly financial planner can help you maximize your money management:

Organize Your Finances

With a weekly financial planner, you can easily keep track of your income, expenses, and savings in an organized manner. It provides you with a clear overview of your financial situation, allowing you to identify areas where you can make improvements, cut unnecessary expenses, and allocate your resources more effectively. By having a structured approach to managing your money, you can regain control over your finances and make informed decisions.

Optimize Your Spending

A weekly financial planner enables you to set spending limits and stick to a budget. By carefully tracking your expenses and categorizing them, you can gain valuable insights into your spending habits and identify areas where you may be overspending. This awareness empowers you to make conscious choices about how you allocate your money, ensuring that you are getting the most value out of every dollar you spend.

Prioritize Your Expenses

One of the keys to financial efficiency is prioritizing your expenses based on your goals and priorities. With a weekly financial planner, you can establish a hierarchy of needs and wants, allowing you to allocate your funds accordingly. Whether it’s saving for a vacation or paying off debt, a financial planner helps you stay focused on your financial goals and make intentional decisions about where your money should go.

By using a weekly financial planner, you can take control of your money management, optimize your spending, and prioritize your expenses. It’s a powerful tool that can help you make the most of your income and achieve financial efficiency.

| Category | Benefits |

|---|---|

| Financial Organization | Provides a clear overview of your income, expenses, and savings |

| Budgeting | Helps you set spending limits and stick to a budget |

| Expense Tracking | Allows you to easily track and categorize your expenses |

| Goal Setting | Enables you to prioritize your expenses based on your goals |

| Financial Efficiency | Optimizes your money management skills for maximum efficiency |

Track Expenses Effectively

Tracking your expenses effectively using a weekly financial planner can bring numerous benefits to your financial management. By closely monitoring where your money is going, you gain valuable insights into your spending habits, allowing you to make informed decisions and improve your overall financial situation.

Expense tracking is a key component of successful budgeting, enabling you to allocate your money wisely and prioritize your spending. With a clear record of your expenses, you can identify areas of overspending and find opportunities to cut back on unnecessary costs, ultimately saving more and achieving your financial goals faster.

By tracking your expenses, you can also detect any discrepancies or errors in your financial transactions, ensuring that you are not being charged for any unauthorized or incorrect charges. This level of scrutiny helps protect your financial security and ensures that your hard-earned money is being used exactly as intended.

Moreover, by using a weekly financial planner for expense tracking, you can establish a historical record of your spending patterns and trends. This information becomes invaluable when creating future budgets and making financial plans. By analyzing your past expenses and understanding your financial behaviors, you can make more accurate projections and set realistic goals for the future.

To illustrate the benefits of expense tracking using a weekly financial planner, consider the following table:

| Expense Category | Amount Spent (per week) |

|---|---|

| Groceries | $150 |

| Entertainment | $100 |

| Rent/Mortgage | $800 |

| Transportation | $50 |

| Utilities | $75 |

This table demonstrates a clear breakdown of weekly expenses across various categories. With this information at hand, you can assess if any category requires adjustments to better align with your financial goals. For example, if you notice that your entertainment expenses are exceeding your budget, you can make conscious decisions to prioritize your spending and reduce costs in this area, reallocating the saved funds to more important priorities.

By leveraging the power of expense tracking through a weekly financial planner, you take control of your financial journey and make meaningful progress towards your financial objectives. Next, I will explore how a weekly financial planner helps you stay ahead of financial challenges, allowing you to navigate unexpected expenses and plan for a secure financial future.

Stay Ahead of Financial Challenges

When it comes to managing your finances, staying ahead of potential challenges is crucial. With a weekly financial planner, you can take control of your budgeting and financial planning, ensuring that you are prepared for any obstacles that may come your way.

One of the key benefits of using a weekly financial planner is the ability to have a clear overview of your finances. By regularly tracking your income, expenses, and savings, you can identify any upcoming expenses or financial commitments that may impact your budget. This allows you to plan ahead and allocate your resources accordingly.

Furthermore, a weekly financial planner enables you to anticipate unexpected emergencies or financial setbacks. By allocating a portion of your budget towards an emergency fund, you can protect yourself from unforeseen circumstances such as medical expenses, car repairs, or home maintenance. This proactive approach ensures that you are prepared for the unexpected and helps you navigate through challenging times without resorting to unnecessary debt or financial stress.

The key to financial success is not just in setting financial goals, but also in actively planning to achieve them.

Budgeting and financial planning are essential tools for maintaining financial stability and achieving your goals. With a weekly financial planner, you can stay ahead of potential challenges and maintain a clear path towards financial success.

To illustrate the benefits of a weekly financial planner, consider the following example:

| Weekly Budget Category | Allocated Amount | Actual Expenses | Remaining Balance |

|---|---|---|---|

| Housing | $500 | $450 | $50 |

| Transportation | $200 | $180 | $20 |

| Groceries | $150 | $170 | -$20 |

| Entertainment | $100 | $90 | $10 |

Based on the example above, utilizing a weekly financial planner allows you to track your actual expenses against the allocated amounts. It helps you identify areas where you may need to adjust your spending to ensure that you stay within your budget and minimize any potential financial challenges.

Additionally, a weekly financial planner provides you with the ability to analyze your spending habits over time. By reviewing your past budgets and expenses, you can identify patterns and make informed decisions about how to modify your financial plan to better align with your goals.

In conclusion, by using a weekly financial planner, you can stay ahead of financial challenges and ensure a more secure financial future. By gaining a clear overview of your finances, anticipating upcoming expenses, planning for emergencies, and avoiding unnecessary debt, you can navigate through any obstacles that may come your way.

Create a Financial Roadmap

When it comes to financial planning, having a roadmap is crucial for success. A weekly financial planner can be your guide, helping you navigate through the twists and turns of managing your finances. By setting clear short-term and long-term financial goals, you can create a roadmap that will lead you towards financial success.

One of the main benefits of using a weekly financial planner is that it provides you with a structured approach to budgeting and saving. With a clear vision of what you want to achieve, you can make strategic decisions that align with your goals. Whether it’s saving for a down payment on a house, starting a business, or planning for retirement, a financial roadmap will help you stay focused and motivated.

By breaking down your goals into manageable milestones, a weekly financial planner allows you to prioritize your actions and track your progress. It enables you to evaluate your financial health on a regular basis and make adjustments as needed. This way, you can stay on course and avoid potential financial pitfalls.

A financial roadmap also helps you make informed decisions about your spending habits and investments. It provides a framework for evaluating opportunities and weighing the risks. With a clear plan in place, you can confidently make choices that will contribute to your long-term financial well-being.

Weekly Financial Planner Example

To give you a better idea of how a weekly financial planner can help you create a financial roadmap, here’s an example to consider:

| Goal | Short-term Milestone | Actions | Target Timeline |

|---|---|---|---|

| Save for a Down Payment | Save $1,000 per month | 1. Cut back on discretionary expenses 2. Open a high-yield savings account 3. Automate monthly transfers |

12 months |

| Pay off Credit Card Debt | Reduce debt by $500 per month | 1. Create a debt repayment plan 2. Prioritize high-interest debt 3. Negotiate lower interest rates |

10 months |

| Invest for Retirement | Contribute 10% of income to retirement account | 1. Set up a retirement account 2. Research investment options 3. Consistently contribute to the account |

Ongoing |

By utilizing a weekly financial planner, you can effectively manage your finances, stay on track, and achieve your financial goals. It empowers you to take control of your financial future and make decisions that align with your aspirations.

Conclusion

In conclusion, incorporating a weekly financial planner into your routine can greatly benefit your financial journey. With its tools and structure, it provides a solid foundation for achieving financial control, maximizing money management, and tracking expenses effectively.

By utilizing a weekly financial planner, you gain the power to take charge of your finances, make informed decisions, and work towards your financial goals. With a clear overview of your income and expenses, you can optimize your spending, prioritize your financial commitments, and ultimately enhance your financial efficiency.

Whether you are looking to save for a new home, plan for retirement, or simply gain a better understanding of your financial situation, a weekly financial planner is an invaluable tool. It empowers you to stay ahead of financial challenges, create a strategic financial roadmap, and make conscious decisions that align with your financial aspirations.

So, take the first step towards securing your financial future and start utilizing a weekly financial planner today. It’s time to take control of your finances, maximize your financial efficiency, and work towards achieving your financial goals.

FAQ

Why should I use a weekly financial planner?

Using a weekly financial planner can help you gain control over your finances and work towards achieving your financial goals. It provides a structured approach to managing your money and allows you to track expenses and budget effectively.

How can a weekly financial planner help me achieve financial control?

A weekly financial planner can help you achieve financial control by tracking your expenses and managing your money effectively. It allows you to have a clear understanding of your financial situation and make informed decisions about your spending habits.

What is the importance of setting and tracking financial goals with a weekly financial planner?

Setting and tracking financial goals with a weekly financial planner helps you stay focused and motivated. It allows you to create a budget, follow budgeting tips, and work towards your financial goals systematically. This ensures that you stay on track and make progress towards achieving your goals.

How can a weekly financial planner maximize my money management skills?

A weekly financial planner can maximize your money management skills by helping you organize your finances, optimize your spending, and prioritize your expenses. It allows you to become more financially efficient and make the most of your income.

What are the benefits of tracking expenses effectively with a weekly financial planner?

Tracking expenses effectively with a weekly financial planner helps you understand where your money is going. It allows you to identify areas of overspending, make adjustments to your spending habits, and improve your overall financial situation.

How can a weekly financial planner help me stay ahead of financial challenges?

A weekly financial planner helps you stay ahead of financial challenges by providing a clear overview of your finances. It allows you to anticipate upcoming expenses, plan for emergencies, and avoid unnecessary debt by making informed financial decisions.

How can a weekly financial planner help me create a financial roadmap?

A weekly financial planner helps you create a financial roadmap by setting short-term and long-term financial goals. It provides you with a structured approach to financial planning, allowing you to make strategic decisions and prioritize your actions to achieve financial success.